Raw material prices have skyrocketed in the last 18 months, causing a headache for both consumers of fossil fuels and clean energy tech. The price of solar projects, for example, is up by a third in some cases, while wind turbine and battery makers have struggled to turn a profit despite strong demand for their products.

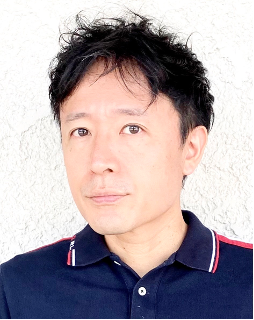

This year promises to be less volatile for raw materials, but it’s too early to breathe a sigh of relief. Japan NRG spoke with Tomono Junichi, a corporate officer for the Primary Metal Unit at Hanwa Co., Ltd., a key Japanese upstream investor and trader of metals used in batteries. He offers a 2023 outlook for critical materials such as lithium, nickel and cobalt, and details expected changes in the battery supply chain.

2023 PRICE OUTLOOK

In 2023, LNG and other fossil fuel prices are forecast to stay high. What’s your outlook for battery metals such as lithium, nickel and cobalt?

The price direction for these metals is generally on the up. It’s hard to see prices decline with such robust demand for batteries. I see lithium trading in the $70-90/ kg range compared to $30-85/kg during 2022. Prices are at historically high levels but demand continues to grow. Market records could be broken again.

My nickel outlook is for $22,000-32,000/ ton in 2023, and $15-30/ lb for cobalt. That compares with a range of $20,000-$48,000 for nickel and $18-38/ lb for cobalt last year.