Since the war in Ukraine divided the global market into two hostile blocs, Japan has had to seek out alternatives to its closest neighbors, Russia and China, for supplies of energy, as well as the metals and critical raw materials (CRMs) that are crucial for the energy transition, which is accelerating with the recent passage of the GX. This new urgency is forcing Japan to look much farther from home for supplies, which in turn increases costs and raises other potential geopolitical risks.

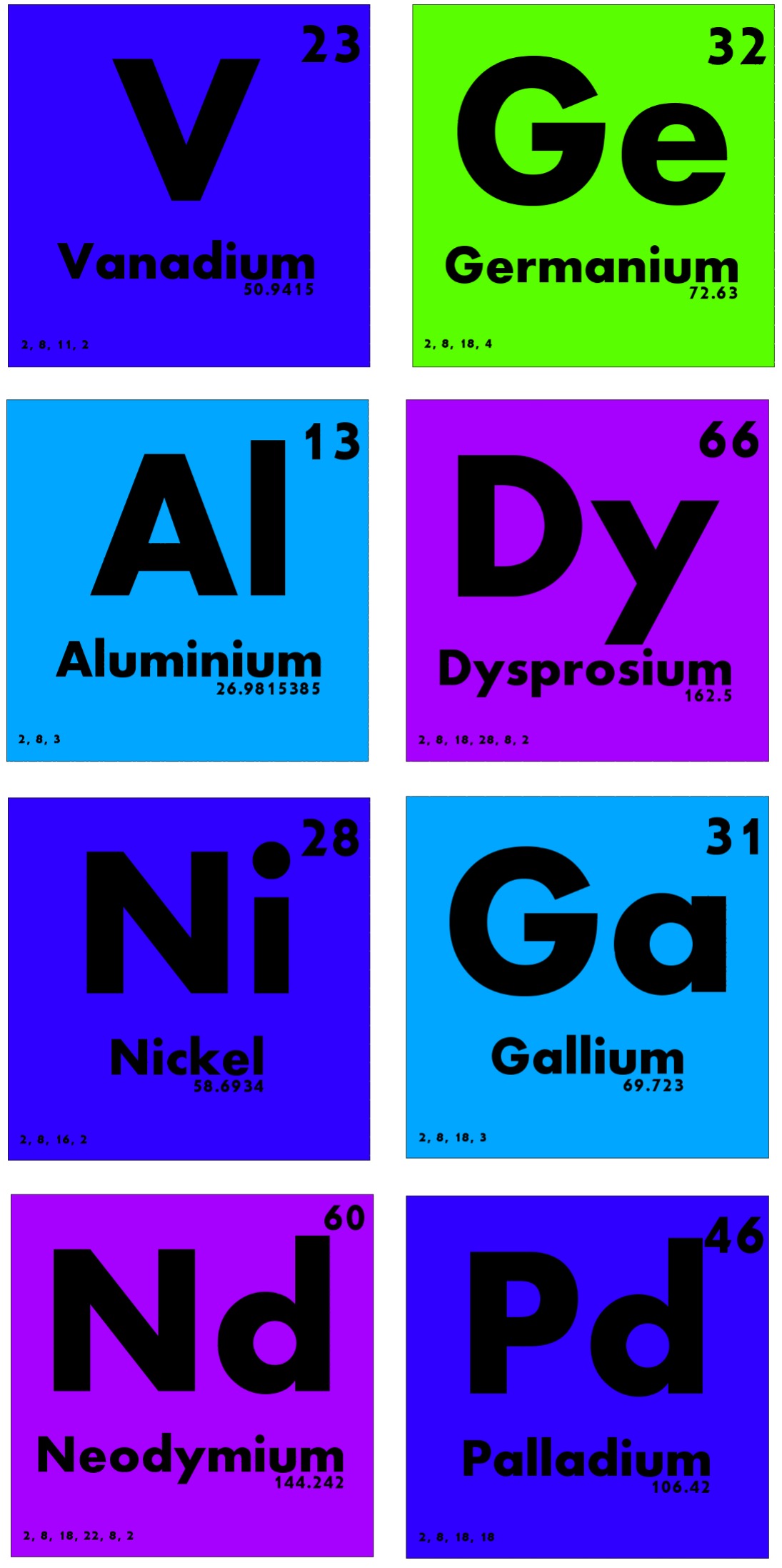

Russia is a major global supplier of aluminum, nickel, palladium and vanadium production, while many of the world’s rare earth metals, such as dysprosium and neodymium, are primarily sourced in China. These metals and CRMs are essential for clean energy technologies, such as electric vehicle motors, solar panels and wind turbines.

Sanctions targeting Russia have excluded it from being a big supplier to G7 countries, and growing tensions with China are also leading to supply chain disruptions. Last month, China began to restrict exports of the rare metals gallium and germanium.

Japan and its G7 allies worry that China will restrict other critical minerals in the near future. Therefore, the Japanese government is seeking solutions. JOGMEC is the state company that will lead this search for CRMs abroad. While close allies in North America and Australia are obvious partners, Africa, the Middle East and India are also now of major interest as potential sources of cobalt, copper, lithium, nickel and other CRMs.

In addition, Japan is eyeing projects with ASEAN nations to recover CRMs from industrial and consumer waste. In short, Japan is open to innovative ideas and scouring the globe for CRM supply that not only reduces emissions but also geopolitical risk.