Cutting CO2 emissions and decarbonization was supposed to be the main topic in global LNG markets last year. Instead, energy security is again front and center, especially for purchasing countries.

In the case of Japan, the security of LNG supply is especially pressing because the fuel has an outsized influence on domestic electricity pricing. Assuming the government sticks to its decarbonization strategy, which says that Japan’s LNG demand for the power sector could drop 50% by 2030, retaining supply security through diversity of import sources could incur a significant monetary cost.

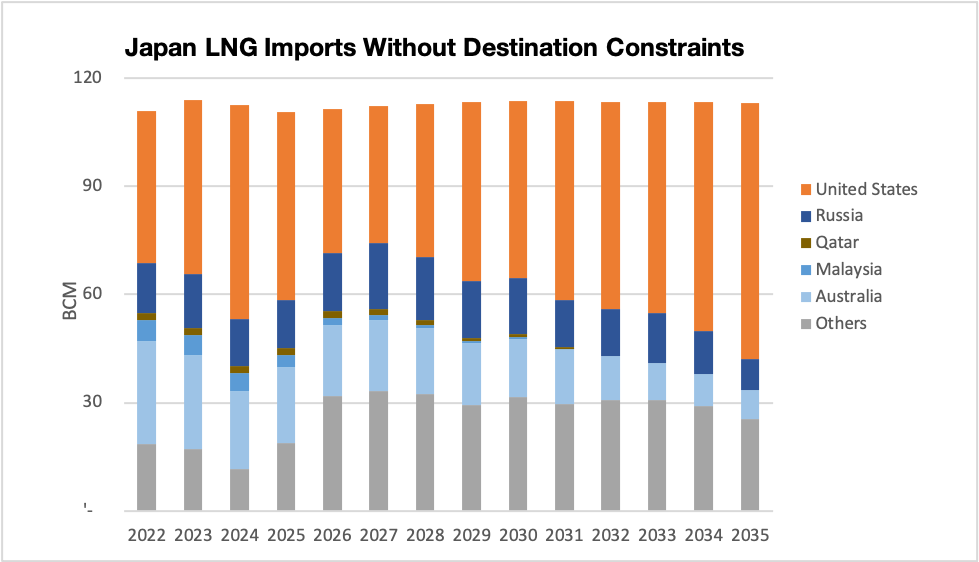

Below we investigate the impact of diversification strategies on Japan and its neighbor, China, which last year emerged as the world’s biggest LNG importer for the first time.

The new “normal” in LNG

The events of 2021 tested both the resilience and flexibility of the global natural gas and LNG markets and demonstrated a new “normal” based on two points:

· LNG has evolved into a truly global market; Europe and Asia, as well as other parts of the world, compete for the same cargos, while local fundamentals such as gas storage levels and renewables output impact LNG prices the world over.

· Gas and LNG supply, even as a bridging fuel, is vital to national security and the broader economy.

In 2021, countries with limited diversity of gas supply were affected heavily by even tiny market fluctuations, demonstrating low price elasticity and a lack of flexibility in switching to alternatives. This led China to build three transnational pipelines and move forward with new LNG regasification terminals along its Southeast coast, while also allocating more funding to domestic gas production projects.

Simulating market change

A diversification strategy for LNG sourcing might be more expensive than a pure cost-base optimization strategy, but our calculations show the price difference may not be prohibitively expensive as the LNG market matures and becomes more competitive after 2030.

To simulate the cost changes…