As Japanese energy planners sit down this spring to update the nation’s strategy, there’s one key assumption they need to rethink entirely. The sixth iteration of the Basic Energy Plan, ratified in October 2021, forecasted that electricity demand would fall 10% this decade thanks to greater efficiency and more conservation. Few would argue that today.

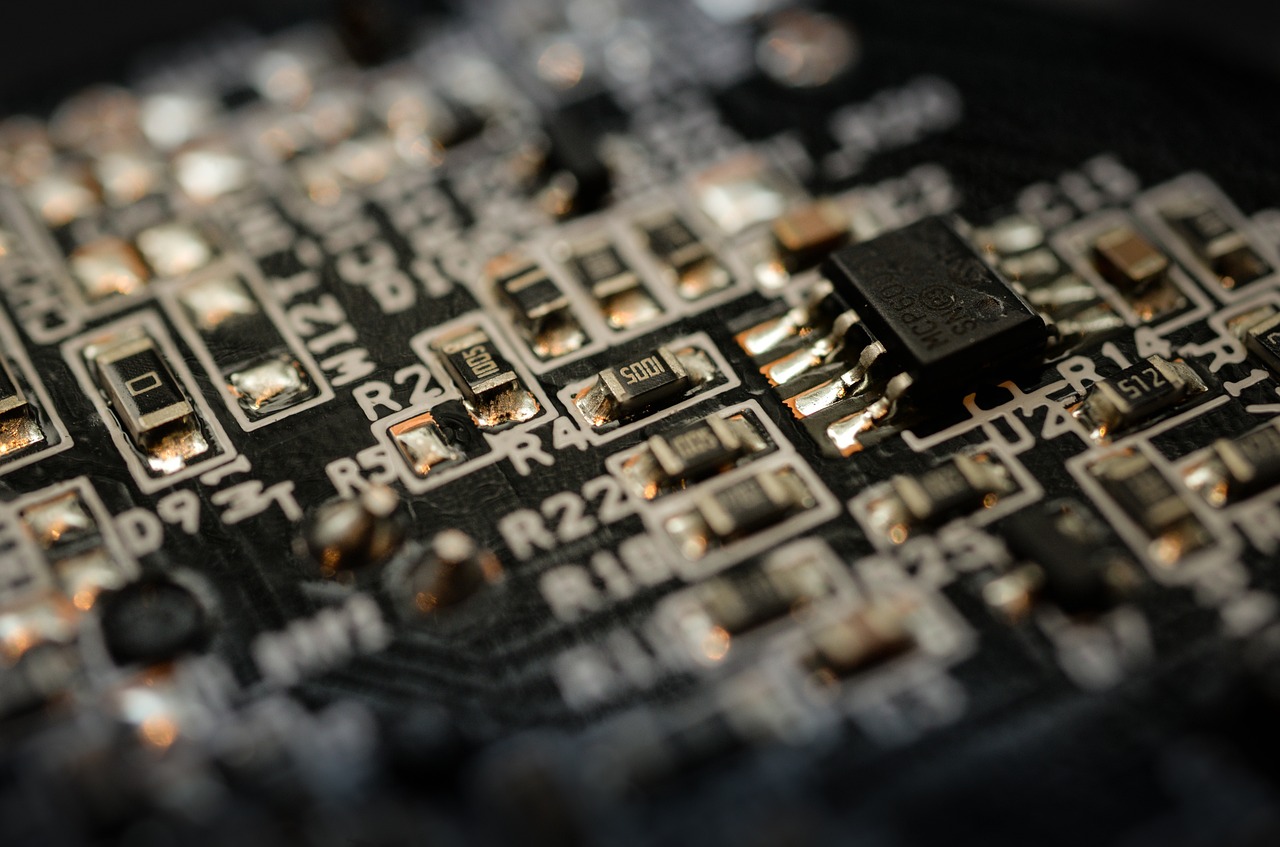

In the last two years, an ambitious state push to revive semiconductor manufacturing in Japan has yielded fruit. The world’s biggest chip maker, Taiwan’s TSMC, opened its first fabrication plant in Japan in late February. As if by coincidence, after 24 straight months without electricity demand growth, March 2024 saw national power consumption tick up. And again, in April.

Within three years, at least two more major semiconductor fabs will open in Japan. Many more facilities that produce components, materials, and equipment for the chip plants are also in the works. That, and the rapid rise of generative AI usage, as well as Japan’s courting of global data centers, could see power demand for the digital sector alone jump by a factor of 10 in a matter of a decade, according to early estimates.

While Prime Minister Kishida’s government has fully backed the semiconductor and AI push, there’s been much less effort to grasp how this will impact the electricity system. Japan’s success at attracting chipmakers and data centers may even have come as a slight surprise. Today, officials are furiously updating their industrial and energy roadmaps. Without a quick reaction, the next surprise could be energy shortages.